Contribution obligations of distributors

Distributors, contributions, payments and payment associations

Status: April 2022

As a distributor of artistic or publishing works, the Artists' Social Insurance Fund contributions are due. It is explained who is a distributor and what exactly the Artists' Social Insurance Fund contributions are. On this page, questions are answered in regard to what are payment subjects, what is not subject to contributions, what is multiple Artists' Social Insurance Fund contributions in case of multiple exploitation, how contribution payments work and what payment associations are.

What are distributors?

Whether someone is a distributor does not depend on their legal form. Distributors may be self-employed persons, companies of any legal form, such as civil partnerships or limited liability companies, or non-profit organisations, such as registered associations. The Artists’ Social Insurance Fund distinguishes between 3 types of distributors:

- Typical distributors exploit artistic or publishing work as part of their business model and include publishers, theatres, orchestras, venues, broadcasters, television production companies, galleries, art dealers, PR agencies, museums and educational institutions.

- Companies and organisations who market or perform PR work for themselves and commission self-employed artistic or publishing work for this constitute their own distributor category. They also have to pay contributions when exceeding the de minimis threshold of EUR 450.

- Other companies (general clause) also have to pay contributions if they ‘more than occasionally’ commission and use self-employed artistic or publishing work to generate income. Contributions also have to be paid when exceeding the de minimis threshold of EUR 450 or when commissioning more than 3 jobs per year.

Artists’ Social Insurance Fund contributions

Distributors of artistic and publishing work must pay Artists’ Social Insurance Fund contributions. How high these contributions are depends on the total fees paid to self-employed persons for their artistic or publishing work during the calendar year. Whether payment recipients are insured under the Artists’ Social Insurance Fund is irrelevant. The contribution rate has been 4.2% since 2018 and remains unchanged in 2022.

In addition to contributions from members and taxes, the budget of the Artists’ Social Insurance Fund is composed to approx. 30% of contributions from distributors. The Artists’ Social Insurance Fund therefore has great interest in collecting these contributions. Since the German Artists’ Social Insurance Act Contribution Monitoring Regulation was amended in 2015, distributors and suspected distributors have been checked more thoroughly, including during audits of the German Pension Insurance.

Payments subject to Artists’ Social Insurance Fund contributions

Payments subject to Artists’ Social Insurance Fund contributions include all payments to self-employed artists (Section 25 of the German Artists’ Social Insurance Act):

- Primary compensation, such as fees

- Licenses

- Cancelation fees for performed work

- Prices paid for works of art

- Benefits in kind, such as meals and accommodation

- Reimbursement of travel and material costs

- Incidental expenses, such as fees of accompanying stage technicians

- Fees for secondary services, such as PR performances

Important: Also subject to contributions are payments to artists from foreign countries or who are not insured under the Artists’ Social Insurance Fund.

Not subject to contributions:

- Fees to legal persons, such as theatre associations or limited liability orchestra companies

- Fees in form of allowances for trainers

- VAT for fees

- Transitory items (transferred invoices with third-party recipients)

- Travel and meal costs within the taxable limit (Section 3 of the German Income Tax Act [Einkommensteuergesetz (EStG)], EUR 60 for meals, EUR 0.30 per kilometre, train tickets)

- Cancelation fees for work not performed or contractual penalties

- Contributions to collection societies (VG Wort, GEMA, etc.)

- Prizes, money from competitions, grants or stipends if no artistic service is provided in return, e.g. a prize for one’s life’s work or an art scholarship

Tip: In case of disputes with the Artists’ Social Insurance Fund, whether payments are subject to contributions is often determined by how they are taxed. A tax advisor may assist you with this. Having invoices with distinct cost items can also help.

Questions and answers:

-

Is it true that travel costs refunded to an artist are subject to contributions, but tickets bought directly from the organiser are not?

Yes, that’s correct. If in doubt, this depends on who issues the invoice and posts the operating expenses. If the artist is treated as a transitory item and the organiser is the invoice recipient, the ticket invoice will also be exempt from contributions.

Yes, that’s correct. If in doubt, this depends on who issues the invoice and posts the operating expenses. If the artist is treated as a transitory item and the organiser is the invoice recipient, the ticket invoice will also be exempt from contributions.

-

Refunds to artists for materials are subject to contributions, but materials purchased by the theatre are not?

Exactly, because: if an invoice is written to the theatre, no contributions will be required. If artists bill their expenses themselves, these items will be subject to contributions.

Exactly, because: if an invoice is written to the theatre, no contributions will be required. If artists bill their expenses themselves, these items will be subject to contributions.

-

Is a grant that require something in return also subject to contributions if only half of the grant is used for the fee and the other half for the costs of the artists?

Yes. As a rule of thumb: when a payment is only provided for something to be done in return and represents an artist’s operating income, Artists’ Social Insurance Fund contributions must be paid. Grants usually require something in return and are therefore subject to contributions (‘false grants’).

Yes. As a rule of thumb: when a payment is only provided for something to be done in return and represents an artist’s operating income, Artists’ Social Insurance Fund contributions must be paid. Grants usually require something in return and are therefore subject to contributions (‘false grants’).

Multiple Artists’ Social Insurance Fund contributions in case of multiple exploitation

The rule is: the direct principal of an artist must pay Artists’ Social Insurance Fund contributions. Multiple exploitation therefore requires multiple contributions.

An example: a civil law theatre partnership commissions a choreographer and a director for a production. The civil law theatre partnership must therefore pay Artists’ Social Insurance Fund contributions for their fees. An organiser then books the production from the civil law theatre partnership. The organiser must pay Artists’ Social Insurance Fund contributions again on the civil law theatre partnership’s invoice.

| Contractor | Distributor | Who has to pay contributions? |

|---|---|---|

| Single artist | Commissioned by a production company | The production company |

| Finished theatre production | Purchased by a theatre | The theatre |

Questions and answers:

-

What about the fee of guest musicians hired by a civil law partnership for a production if an invoice is written to the principal for the entire production?

When commissioning artistic work from self-employed artists, the civil law partnership will have to pay contributions—including for the guest musicians. Whether contributions must be paid depends on the contractual relationship. The company that purchased the production must pay Artists’ Social Insurance Fund contributions for the total fee and the civil partnership has to pay contributions for the fees of the commissioned artists.

When commissioning artistic work from self-employed artists, the civil law partnership will have to pay contributions—including for the guest musicians. Whether contributions must be paid depends on the contractual relationship. The company that purchased the production must pay Artists’ Social Insurance Fund contributions for the total fee and the civil partnership has to pay contributions for the fees of the commissioned artists.

-

If you commission a guest performance, do you have to pay Artists’ Social Insurance Fund contributions for it? And do contributions have to be paid for one or for every guest performance?

Guest performances are also subject to contributions. However, this does not apply only to guest performances, but to all contracts for self-employed artistic services. Contributions are charged for the invoiced fee, not per performance.

Guest performances are also subject to contributions. However, this does not apply only to guest performances, but to all contracts for self-employed artistic services. Contributions are charged for the invoiced fee, not per performance.

-

What about the civil law partnership organising the event?

The civil law partnership does not have to pay contributions for its partners. However, if the civil law partnership commissions another actress or an external lighting designer, Artists’ Social Insurance Fund contributions must be paid for their fees.

The civil law partnership does not have to pay contributions for its partners. However, if the civil law partnership commissions another actress or an external lighting designer, Artists’ Social Insurance Fund contributions must be paid for their fees.

-

What about contribution payments when a theatre pays a co-production payment to a cooperation partner, on a contractual basis and without a separate invoice?

The co-production payment is in principle subject to contribution payments regardless of whether the due date follows from the invoice or directly from the contract.

The co-production payment is in principle subject to contribution payments regardless of whether the due date follows from the invoice or directly from the contract.

Contribution payment

Registration

Distributors are required by law to register with the Artists’ Social Insurance Fund. In many cases, the Artists’ Social Insurance Fund will send registration notices. Distributors must cooperate and provide invoices and contracts and disclose payments and contractor data.

Freelancers have to state ‘individual entrepreneur’ as their legal form on the application form.

Point 4.1 asks which artistic work was commissioned in the last 5 years.

Point 5 asks about the fee total paid for all self-employed artistic and publishing work in the last 5 years. Back payments of unreported contributions for this entire period can obviously be expensive.

Annual payment reporting obligations

After registering, payments from the previous year until March 31 of the next year have to be reported annually. The Artists’ Social Insurance Fund will send a template. Reports also have to be submitted if no payments were made.

The form only asks for the total payment amount. Accurate assignments and totals of all payments subject to contributions require proper accounting.

If Artists’ Social Insurance Fund contributions are due, you will receive notice. Refunds may be possible due to advance payments. Amounts can easily be reviewed if you have all payment invoices and know the contribution rate (2018 – 2022: 4.2%).

Advance payments are determined based on the contributions of the previous year and are only required if more than EUR 40 will likely have to be paid in contributions (2021: if annual payments exceed approx. EUR 952). Advance payments for each month are due on the 10th of the following month and may be reduced if too high and requested (Section 27(5) of the German Artists’ Social Insurance Fund Act). Such requests must be substantiated with figures to prove that, e.g. a one-time project required fees in the previous year. You may also use monthly comparisons to show that this year’s payments will be lower than last year’s.

If you fail to submit a report despite notice, your contributions may be determined by the Artists’ Social Insurance Fund based on estimates. Contribution obligations expire 4 years after the end of the year in which the contributions became due, i.e., contributions for 2021 will expire in 2026.

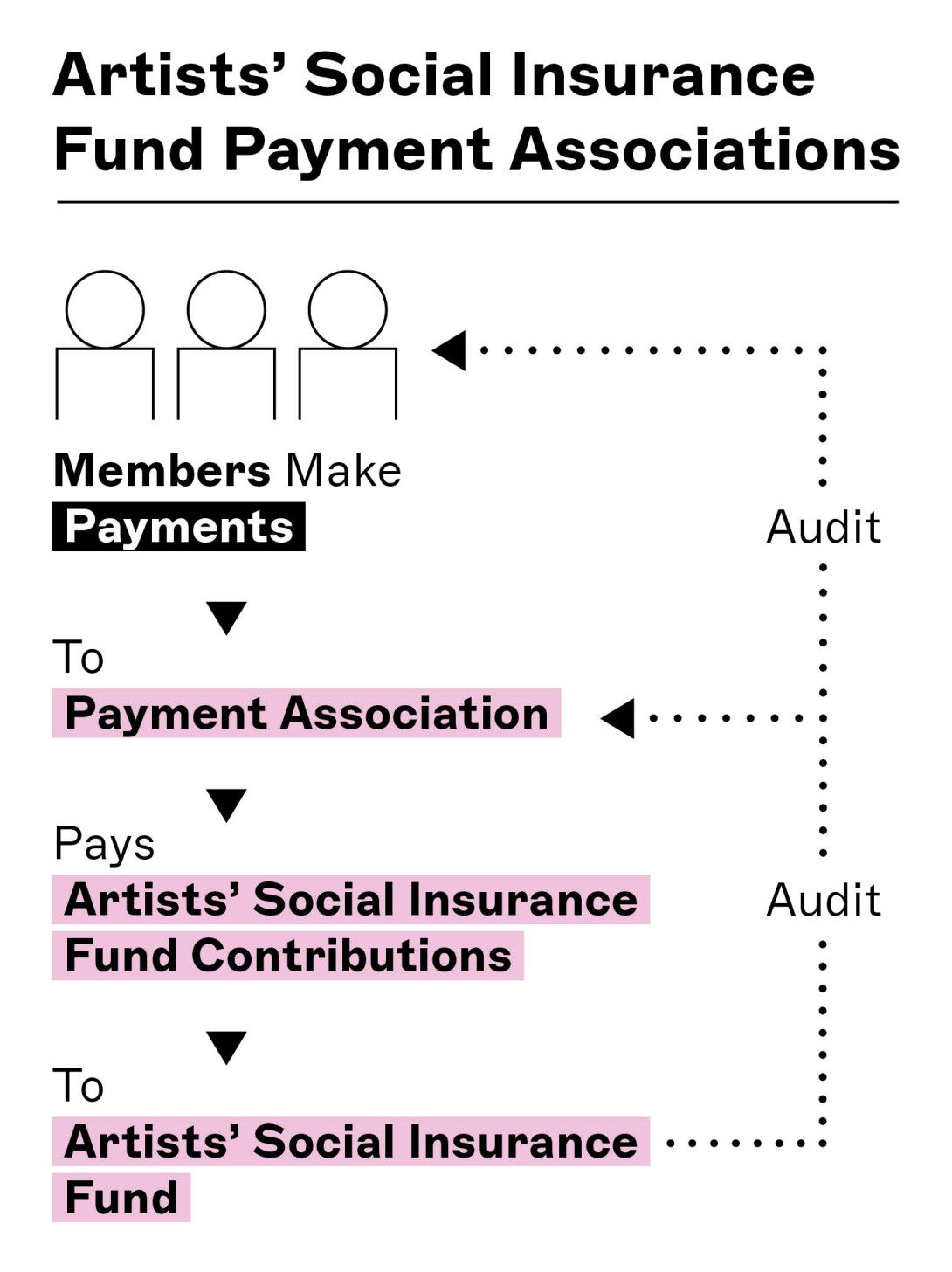

Payment associations [Ausgleichsvereinigungen]

Distributors of an industry may form a payment association to agree on Artists’ Social Insurance Fund contributions with the Artists’ Social Insurance Fund for the association’s members. There are currently about 60 payment associations, mostly as registered associations.

Payment associations are responsible for payments to the Artists’ Social Insurance Fund for the association’s members—who no longer have to submit payment reports to or engage in disputes with and won’t be audited by the Artists’ Social Insurance Fund. Late fees or back payments will no longer be charged. Payments will only be collected from members by the payment association. Standard cost allocations provide members with legal and mathematical certainty.

Payments of payment associations to the Artists’ Social Insurance Fund are not only based on the compensation members pay to artists. Other factors, such as revenue, income, fees or expenses, may be agreed with the Artists’ Social Insurance Fund.

Forming a payment association is difficult and requires negotiating with the Artists’ Social Insurance Fund and approval by the German Federal Office for Social Security. However, members will enjoy significantly less bureaucracy. Reports to, audits by and discussions and disputes with the Artists’ Social Insurance Fund will be a thing of the past and handled solely by the payment association.

Example: Payment Association of the Registered Baden-Württemberg State Association of Independent Dancers and Theatre Workers [Ausgleichsvereinigung des Landesverbands Freie Tanz- und Theaterschaffende Baden-Württemberg e.V.]

Payments of members of this payment association are determined by the following formula:

Revenue of the 2nd last year x individual percentage rate x artist contribution rate

The individual percentage rate of every new member is determined by the Artists’ Social Insurance Fund based on fee payments subject to contributions and the revenue of the last 3 years, i.e., income and fees paid. Members report their revenue of the 2nd last year to the payment association which redetermines its required payments every year. These payments are due monthly, quarterly or annually, depending on their amount. The payment association may review its members’ books.

Another payment association for performing arts is the Sociocultural Association of the German Federal State of Saxony [Landesverband Soziokultur Sachsen].