Application process

How-to: Applying to the Artists' Social Insurance Fund

Status: April 2022

Determining insurance obligations

To join the Artists’ Social Insurance Fund, you must complete an application form with 27 questions. All answers must be accurate and complete. You may be fined for misstatements. The ‘Application Form for Determining Insurance Obligations’ may be downloaded from the website of the Artists’ Social Insurance Fund. This form is used to determine 3 things:

- Is the applicant’s work artistic?

- Is the applicant self-employed?

- Does the applicant perform this work to earn income, i.e., professionally and not as hobby?

Proof of artistic quality or an artist’s CV are not required by the application form.

3 work requirements for Artists’ Social Insurance Fund insurance:

- Self-employed (primary work)

- Artistic

- Professionally, not as a hobby

Important: Keep copies of all submitted information and documents in case of questions or disputes.

The Artists’ Social Insurance Fund normally asks questions in standardized form. You may call the Artists’ Social Insurance Fund Monday thru Friday from 9 AM – 4 PM at +49 (0) 4421 973 405 1500.

Parts of the application that may be unclear are explained below.

Explanation of the Artists’ Social Insurance Fund application form

Point 1: Work information

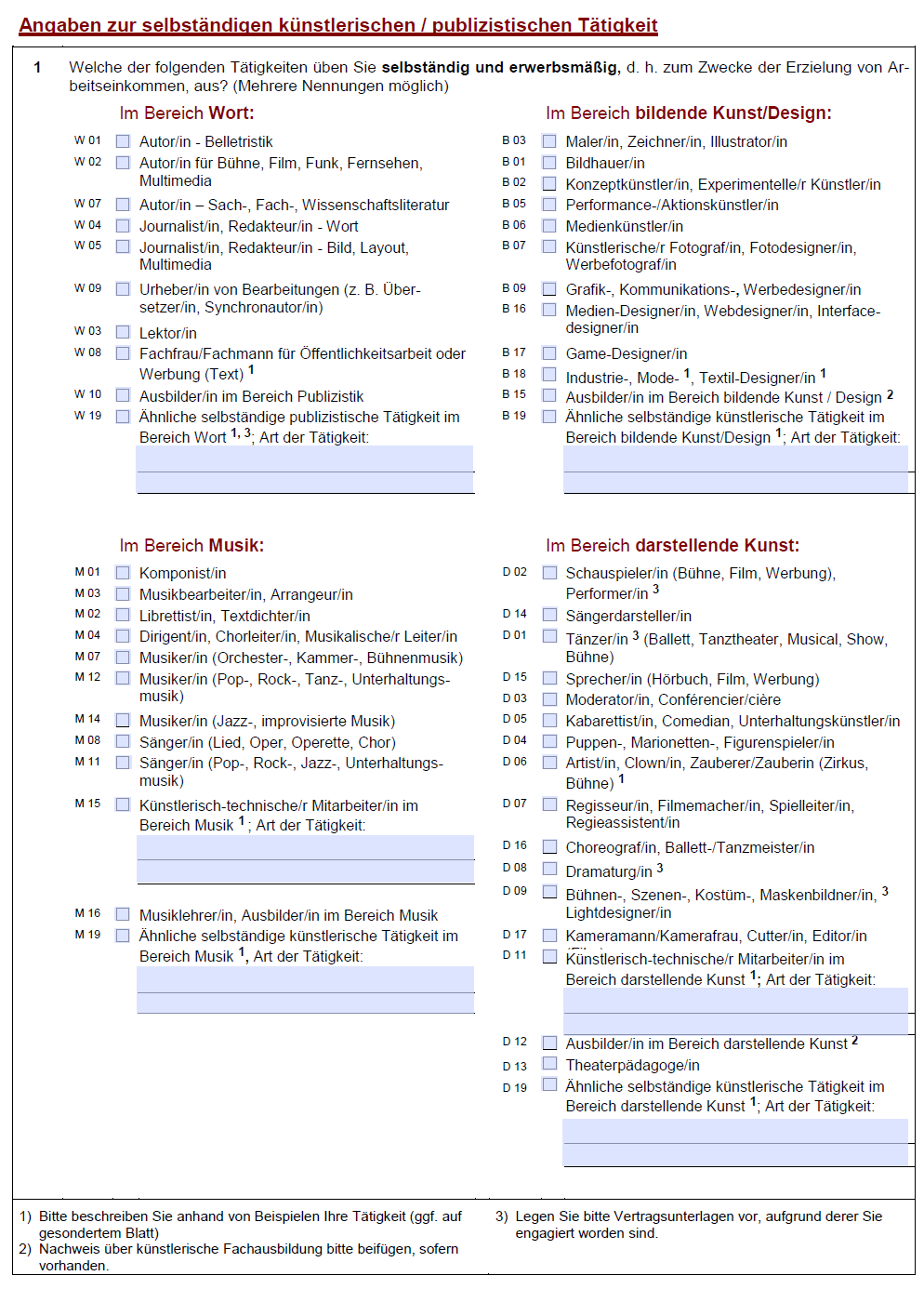

The application form includes a list of artistic professions from which you must pick your line of work. You may pick more than one. If your profession is not listed, choose ‘Similar work’ (for performing arts: D19).

Some options have footnotes with further explanations:

- Footnote 1: ‘Please use examples to describe your work.’ Informally explain what you do and the creative quality of your work. This applies to, e.g. technical employees in the arts, acrobats and work not included in this list.

- Footnote 2: ‘Please include proof of your artistic education, if available.’ In addition to proof of their work, art teachers must submit proof of their education. This is required of, e.g. music educators for young children.

- Footnote 3: ‘Please submit the contractual documents under which you were hired.’ This is required for work often performed by contractors, such as actors, dramaturges or set designers. Contracts must state that the applicant is self-employed.

Point 2: Proof of work activity

The Artists’ Social Insurance Fund requires evidence in form of contracts, invoices, income lists and account statements proving that you perform your artistic work to generate income (Point 2.1). Important: Documents of examples of 3 jobs with the invoices and received payment suffice. These documents should not be older than 1 year. Missing current evidence cannot be substituted with older documents.

You may further prove that you perform artistic work to generate income by submitting your website (Point 2.2), advertisement, qualifications, prices, stipends or publications about performances or concerts. However, not having such evidence won’t necessarily prevent you from joining the Artists’ Social Insurance Fund.

Point 5: Start of work

This is used to determine when you started your profession. Background: The minimum income of EUR 3,900 per year is not required for the first 3 years of artistic work. If you have been working as an artist for longer, you will lose this exemption, but suffer no other adverse effects.

Point 6: Employees

Artists with more than 1 employee cannot be insured under the Artists’ Social Insurance Fund. Employees earning EUR 450 and trainees do not count.

Point 7: Projected income

When projecting income, likely expenses must be deducted from estimated earnings. This requires accounting to compare income and expenses. If your projected income from artistic work is less than EUR 3,900, you cannot be insured under the Artists’ Social Insurance Fund. However, this limit only applies after 3 years of self-employment—and exceptions apply due to Covid.

Note: Even if your income is less than EUR 3,900, this amount will be used to determine your contributions which will therefore be at least approx. EUR 80 per month.

Point 9: Where do you perform your work?

The Artists’ Social Insurance Fund is only available to artists subject to German social security law. If you perform all your work in another country, you cannot be insured under the Artists’ Social Insurance Fund. If you work both in and outside of Germany, working in another country for up to 24 months is normally permitted. But if you work abroad for longer or for a contractually-indefinite period, you will be unable to join the Artists’ Social Insurance Fund.

Point 11: Other employment

The Artists’ Social Insurance Fund wants to know if your self-employed artistic activities are your primary profession or if your social security obligations are determined based on employed work.

If you perform more than 20 hours of employed work per week and/or earn more than gross EUR 1,645 per month (half-monthly reference, amount for 2021 and 2022, changes regularly), you must at least pay social security contributions for health and nursing care insurance for this work. Other indicators of primarily performing employed work: earning more than 120% of your income from or working more than 120% as much as under self-employment.

Note: Even if your employment represents your primary profession, you may have to pay pension insurance contributions to the Artists’ Social Insurance Fund if you earn more than EUR 3,900 per year as a self-employed artist. In this case, you will have to pay pension insurance contributions for both your primary and secondary work.

Point 12: Other self-employment

This asks whether you perform other self-employed work that is not artistic or related to publishing. This applies, e.g. if a self-employed dramaturge also works as a freelance Spanish teacher. This information is necessary for determining your primary work for social security purposes. Your primary work is determined based on your income from all of your self-employed activities. The limit for non-artistic self-employment is EUR 5,400 per year. If you earn more than this, you will at least have to pay health and nursing care insurance contributions to the Artists’ Social Insurance Fund. You may also have to pay pension insurance contributions to the Artists’ Social Insurance Fund if you earn at least EUR 3,900 per year from your self-employed artistic work.

Important: Due to Covid, the additional income limit for 2021 and 2022 was raised to EUR 15,600 per year (see the announcement on the website of the Artists’ Social Insurance Fund).

Point 20: Students

You can be under the Artists’ Social Insurance Fund as a self-employed artist while you are a student. Under the German Artists’ Social Insurance Act, you must be insured under the Artists’ Social Insurance Fund instead of your student health insurance company if you work more than 20 hours per week. However, the Artists’ Social Insurance Fund will also provide pension insurance.

Questions and answers:

-

Is it true that curators are not eligible for the Artists’ Social Insurance Fund? How can they join?

Whether curators will be admitted is decided on a case-by-case basis and depends on the overall work. General recommendations are not possible, but you should explain the entire range of your tasks and additional artistic activities, such as performances.

Whether curators will be admitted is decided on a case-by-case basis and depends on the overall work. General recommendations are not possible, but you should explain the entire range of your tasks and additional artistic activities, such as performances.

-

When applying for readmission after 10 years, the Artists’ Social Insurance Fund asks for advertisement and proof of publications. I don’t have that. What can I do?

Explain to the Artists’ Social Insurance Fund that your readmission is de facto a new application and these things aren’t available yet. If you don’t have jobs or advertisements yet, you can submit your marketing and acquisition plans instead.

Explain to the Artists’ Social Insurance Fund that your readmission is de facto a new application and these things aren’t available yet. If you don’t have jobs or advertisements yet, you can submit your marketing and acquisition plans instead.

-

What are an artist’s operating expenses? Is there a list? Is this determined at my discretion? Does rent count?

Operating expenses are determined by tax law. Only expenses related to your self-employment, such as costs of further education, telephone and Internet bills, materials, technical equipment, rehearsal spaces or fees paid to other artists, may be deducted. The rent of your private apartment does not count.

There is no complete list. However, the North Rhine-Westphalian State Office for the Independent Performing Arts published FAQ about self-employment which include information about operating expenses.

Operating expenses are determined by tax law. Only expenses related to your self-employment, such as costs of further education, telephone and Internet bills, materials, technical equipment, rehearsal spaces or fees paid to other artists, may be deducted. The rent of your private apartment does not count.

There is no complete list. However, the North Rhine-Westphalian State Office for the Independent Performing Arts published FAQ about self-employment which include information about operating expenses.

-

Does short-term work that lasts 6 weeks have to be reported to the Artists’ Social Insurance Fund?

Yes, and include the contract and explain that you will continue to perform self-employed artistic work. Otherwise, the Artists’ Social Insurance Fund may assume that your coverage will end. If this work is subject to social security contributions, you won’t have to pay health or nursing care contributions to the Artists’ Social Insurance Fund for this period. However, you will still have to pay pension insurance contributions, but will remain insured under the Artists’ Social Insurance Fund. After finishing this work, full contribution obligations will resume without requiring another application.

Yes, and include the contract and explain that you will continue to perform self-employed artistic work. Otherwise, the Artists’ Social Insurance Fund may assume that your coverage will end. If this work is subject to social security contributions, you won’t have to pay health or nursing care contributions to the Artists’ Social Insurance Fund for this period. However, you will still have to pay pension insurance contributions, but will remain insured under the Artists’ Social Insurance Fund. After finishing this work, full contribution obligations will resume without requiring another application.

-

How are rental and capital income assessed?

Such income is irrelevant to Artists’ Social Insurance Fund obligations as long as it generated from private asset management. This even applies if private rental income exceeds the income from your artistic work. For commercial investments in real estate or securities, the limit is EUR 5,400.

Such income is irrelevant to Artists’ Social Insurance Fund obligations as long as it generated from private asset management. This even applies if private rental income exceeds the income from your artistic work. For commercial investments in real estate or securities, the limit is EUR 5,400.

-

Can a student with private health insurance join the Artists’ Social Insurance Fund and receive statutory health insurance by becoming a self-employed artist?

Yes. In this case, the Artists’ Social Insurance Fund will act as the ticket to statutory health insurance. The student first has to choose a health insurance company. The company will then issue tentative proof of insurance which can be used to apply to the Artists’ Social Insurance Fund. Anyone admitted to the Artists’ Social Insurance Fund is also admitted to a health insurance company.

Yes. In this case, the Artists’ Social Insurance Fund will act as the ticket to statutory health insurance. The student first has to choose a health insurance company. The company will then issue tentative proof of insurance which can be used to apply to the Artists’ Social Insurance Fund. Anyone admitted to the Artists’ Social Insurance Fund is also admitted to a health insurance company.